geoffreyginokuna.site Overview

Overview

Purpose Of Budgeting

The purposes of capital budgets are to allocate funds, control risks in decision-making, and set priorities. 3. Cash budget. Cash budgets tie the other two. One of the reasons why budgeting is important is because it can help you achieve your financial goals. These goals can be anything – you may be budgeting for a. The purpose of budgeting is to control managers in their spending of money, we must allocate budgets based on conservative income projections. A detailed budget sets realistic goals for your projects and ensures proper resource allocation to prevent costly spending overflows. Why the Budgeting Process. Budgeting can help you set long-term financial goals, keep you from overspending, help shut down risky spending habits, and more. Budgeting is essential for businesses and individuals as it facilitates financial planning, expense control, goal setting, decision-making, cash flow. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. The link between instructional goals and financial planning is critical to effective budgeting and enhances the evaluation of budgetary and educational. The purpose of budgetary accounting is to monitor and control the state's financial activities to the level and purpose specified in the annual Budget Act. The purposes of capital budgets are to allocate funds, control risks in decision-making, and set priorities. 3. Cash budget. Cash budgets tie the other two. One of the reasons why budgeting is important is because it can help you achieve your financial goals. These goals can be anything – you may be budgeting for a. The purpose of budgeting is to control managers in their spending of money, we must allocate budgets based on conservative income projections. A detailed budget sets realistic goals for your projects and ensures proper resource allocation to prevent costly spending overflows. Why the Budgeting Process. Budgeting can help you set long-term financial goals, keep you from overspending, help shut down risky spending habits, and more. Budgeting is essential for businesses and individuals as it facilitates financial planning, expense control, goal setting, decision-making, cash flow. A budget is a plan you write down to decide how you will spend your money each month. A budget helps you make sure you will have enough money every month. The link between instructional goals and financial planning is critical to effective budgeting and enhances the evaluation of budgetary and educational. The purpose of budgetary accounting is to monitor and control the state's financial activities to the level and purpose specified in the annual Budget Act.

Creating a budget allows you to keep track of your purchases and save money. Whether you're saving up for a vacation or simply trying to cut back on your. Budgeting is a crucial financial tool that helps individuals and households effectively manage their money. Resource allocation; Planning; Coordination; Control; Motivation. Also read: Budget Deficit · Difference Between Standard Costing and Budgetary Control · The. This is where the budget assumes a special importance because project expenditures are strictly limited to the items authorized by the approved project budget. 1. Budgeting Can Help You in an Emergency · 2. Budgeting Can Help with Retirement · 3. Budgeting Can Help You Fix Bad Spending Habits · 4. Budgeting Gives You. The purpose of budgeting is to control managers in their spending of money, we must allocate budgets based on conservative income projections. 1. It shows you where your money is going. · 2. It helps you identify waste. · 3. It helps you make financial decisions. · 4. It helps you reach your goals. · 5. It. Identifying your priorities and goals · Creating a budget document that outlines your estimated monthly income and expenses · Tracking your actual spending and. Planning provides a framework for a business' financial objectives — typically for the next three to five years. · Budgeting details how the plan will be carried. Answer and Explanation: 1. Planning, controlling, and evaluating performance are the three primary goals of budgeting. Planning: Budgeting is a planning tool. The purpose of a budget is to help you meet your financial goals, both now and in the future: Short-Term: months (example: buying books next quarter. Benefits of Budgeting. Budgeting provides a systematic way of reviewing estimated with actual results, coordinating future activities and setting realistic. Budgeting for your business allows you to set clear goals, control spending, and save for future needs. It aligns money use with business aims, ensuring a. Establish City goals and major performance objectives. · Approve guidelines for preparing the annual operating budget. · Establish through adoption of an annual. A well-crafted budget helps set goals, make informed decisions, manage cash flow, allocate resources efficiently, and evaluate performance. A budget can help you determine your long-term goals and put you on the path of working towards them. Having a set criteria or map of how to allocate your. Creating a budget · Step 1: Calculate your net income · Step 2: Track your spending · Step 3: Set realistic goals · Step 4: Make a plan · Step 5: Adjust your. Budgeting for your business allows you to set clear goals, control spending, and save for future needs. It aligns money use with business aims, ensuring a. The primary function of financial budgeting is to ensure core resources are available as needed to implement plans and achieve business goals. Advance planning. More specifically, it is the “amount of money that is available for, required for, or assigned to a particular purpose” ("Definition of BUDGET", ).

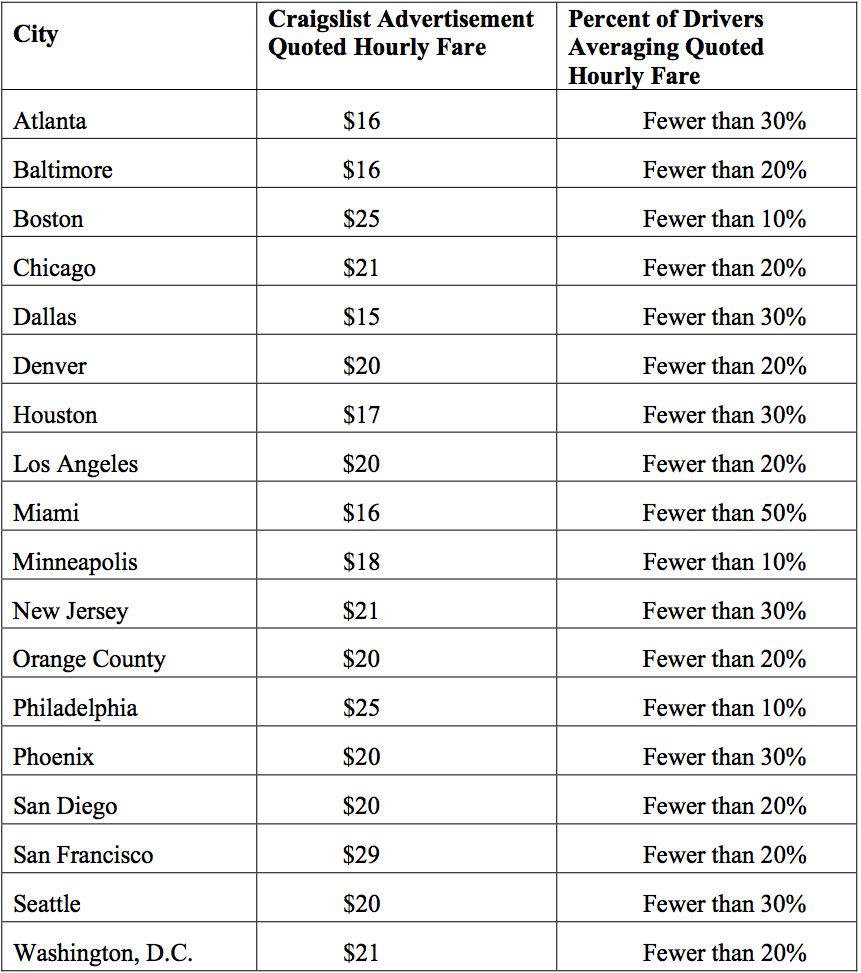

Uber Driver Average Pay Per Day

Get paid extra for trips in certain areas at busy times. Example: earn an extra $6 for completing 3 trips in a row with the first trip starting downtown between. During special events and weekend nights, drivers sometimes make % more than that. Full time drivers can expect to make at least $50k/year after expenses. I averaged ~ $14 per hour. It should be noted that 3–6 hours of weekend work during surge is what made this average. Assuming a 40 hour working week, Uber X drivers could expect to earn around $30, per year based on earnings alone. If an Uber Black driver consistently earns. The other 90% of drivers average $50 to $ per day. Again There are 3 markets in USA where uber is mandated to pay a minimum "wage" by law. When you factor in all the hidden costs offloaded onto drivers, our first-of-its-kind study based on real driver data shows their average net earnings are just. How much do Uber Driver jobs pay per hour? The average hourly pay for a Uber Driver job in the US is $ Hourly salary range is $ to $ Average Uber driver income is $ per hour after expenses and fees. High Time of Day and Day of the Week; Type of Vehicle Used; Driver. Technically, a driver could make $ in a day with Uber — if everything fell into place. In May , The Washington Post reported that some drivers in big. Get paid extra for trips in certain areas at busy times. Example: earn an extra $6 for completing 3 trips in a row with the first trip starting downtown between. During special events and weekend nights, drivers sometimes make % more than that. Full time drivers can expect to make at least $50k/year after expenses. I averaged ~ $14 per hour. It should be noted that 3–6 hours of weekend work during surge is what made this average. Assuming a 40 hour working week, Uber X drivers could expect to earn around $30, per year based on earnings alone. If an Uber Black driver consistently earns. The other 90% of drivers average $50 to $ per day. Again There are 3 markets in USA where uber is mandated to pay a minimum "wage" by law. When you factor in all the hidden costs offloaded onto drivers, our first-of-its-kind study based on real driver data shows their average net earnings are just. How much do Uber Driver jobs pay per hour? The average hourly pay for a Uber Driver job in the US is $ Hourly salary range is $ to $ Average Uber driver income is $ per hour after expenses and fees. High Time of Day and Day of the Week; Type of Vehicle Used; Driver. Technically, a driver could make $ in a day with Uber — if everything fell into place. In May , The Washington Post reported that some drivers in big.

It's relatively easy to make $15 - $20 an hour driving for Uber. But how about making over $ an hour or six figures driving for Uber? How much does a Uber driver make in Illinois? The average uber driver salary in Illinois is $35, per year or $ per hour. Entry level positions start. When driving, you can make informed decisions on the spot about single trip requests. But what if Uber could also support you in decisions about your day. It facilitates an average of 28 million trips per day and has facilitated 47 billion trips since its inception in In , the company had a take rate . After taking all deductions into account, the average Uber driver will generally take home $ from a minute ride. What are Uber's best/busiest work hours? Wonder how much drivers can make with Uber? Learn about earnings, how they're calculated, how in-app promotions work, and more. If you work 40 hours per week, 52 weeks out of the year, then that's a yearly salary of just over $36, How do you become an Uber Eats driver? The average Driver base salary at Uber is $21 per hour. The average additional pay is $0 per hour, which could include cash bonus, stock, commission, profit. One of the great perks of being an Uber driver is the ability to earn tips. A recent study showed Uber drivers earn hundreds of millions in tips per year and. average earnings from driving for Uber at various times of day and night. A per hour by 19% to give your hourly take home salary after tax. If you. How much does a Uber Driver make in USA? The average uber driver salary in the USA is $36, per year or $ per hour. Entry level positions start at. How much do Uber Driver jobs pay in New York per hour? The average hourly salary for a Uber Driver job in New York is $ an hour. How much does an Uber Driver make? The average annual salary of Uber Driver in the United States is $ or $19 per hour, ranging from $ to $ Uber Eats delivery drivers earn a national average hourly income of $ While some drivers can make as much as $28 per hour, others earn much less. 24% of Uber. Depending on how often you work and other external factors, the typical full-time net income range is anywhere from $37, to $54, Once you've established. For example, 35% of Uber drivers work 12 to 19 hours a week. On top of this, Uber drivers make an average of $19 per hour. Therefore, say you worked 12 hours at. During special events and weekend nights, drivers sometimes make % more than that. Full time drivers can expect to make at least $50k/year after expenses. But the fact is that the average salary for Uber drivers in the U.S. is about $63, a year as of October 22, , which is 15% above the national average. Need your money now? No worries · Cash out with Instant Pay up to 6 times per day · To do this, open the menu in the app and tap Earnings, then Cash out. Uber Black drivers earn $25 an hour. Assuming a 40 hour working week, Uber X drivers could expect to earn around $30, per year based on earnings alone. If an.

Refinance Mortgage Home Equity Loan Calculator

Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. You have $, in equity in your home. You could refinance your home. Your new loan would pay off your current mortgage and you would get the cash difference. Use our cash out refinance calculator to find out how you may be able to replace your current mortgage with a new one and tap into your home equity with a. Compare the cost of a HELOC vs a Cash-Out Refinance with Figure's savings calculator No mortgage solicitation activity or loan applications for. Use this home equity loan vs cash-out refinance calculator to see which of these two options will be cheaper for you in the long run. Potentially lower interest rates: Cash-out refinances may offer lower interest rates than home equity loans. But while home equity loans are riskier for lenders. Free calculator to plan the refinancing of loans by comparing existing and refinanced loans side by side, with options for cash out, mortgage points. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Mortgage Consolidation Refinance Calculator. This calculator makes it easy for homeowners to decide if it makes sense to refinance their first and second. Use our home equity line of credit (HELOC) payoff calculator to figure out your monthly payments on your home equity line based on different variables. You have $, in equity in your home. You could refinance your home. Your new loan would pay off your current mortgage and you would get the cash difference. Use our cash out refinance calculator to find out how you may be able to replace your current mortgage with a new one and tap into your home equity with a. Compare the cost of a HELOC vs a Cash-Out Refinance with Figure's savings calculator No mortgage solicitation activity or loan applications for. Use this home equity loan vs cash-out refinance calculator to see which of these two options will be cheaper for you in the long run. Potentially lower interest rates: Cash-out refinances may offer lower interest rates than home equity loans. But while home equity loans are riskier for lenders. Free calculator to plan the refinancing of loans by comparing existing and refinanced loans side by side, with options for cash out, mortgage points. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Mortgage Consolidation Refinance Calculator. This calculator makes it easy for homeowners to decide if it makes sense to refinance their first and second.

Home Buyer Assistance Programs · Mortgage Glossary. Calculators. Mortgage Initial rates displayed are based on a $, loan for a purchase or refinance. Refinancing your mortgage can allow you to access available equity by taking cash out. Start with our refinance calculator to estimate your rate and payments. Home Equity Calculator. Use our calculator to estimate your monthly mortgage payment. Today's Texas Rates: *View APR Disclosure. For example, a lender's 80% LTV limit for a home appraised at $, would mean a HELOC applicant could have no more than $, in total outstanding home. See how much you might be able to borrow from your home. Just enter some basic information in our home equity loan calculator to find out. ON THIS PAGE. A home equity loan is often referred to as “a second mortgage” and is taken out in one lump sum. A HELOC is a line of credit you can draw funds from as needed. To view Home Equity Loan rates, visit our Home Equity Loans. To apply for a Home Loan Calculators. ARM vs. Fixed Rate Mortgage · Mortgage Comparison. With our HELOC vs cash out refi calculator you can quickly see your estimated HELOC or refi rate and HELOC or refi payment. Use our mortgage refinance calculator to estimate your new mortgage terms, loan amount, and interest rates payment, or pulling cash out of your home equity. A HELOC payment calculator makes estimating your monthly payments and interest rate easy. Check out Flagstar to plan your mortgage payments. Rocket Mortgage offers a couple ways to do this: Cash-out refinance; Home equity loan. You won't be able to take out the full amount of equity that you have. We list current Mountain View HELOC & home equity loan rates as well as current Mountain View mortgage rates to help you perform your calculations and select a. Advantages of a cash-out refinance: Lower interest rates. Cash-out refinances are first mortgages, so. A home equity loan is a mortgage option that allows a borrower to get a loan to help them access their home equity, like a cash-out refinance. Borrowers can. Home Equity LoanJumbo SmartONE+ By Rocket Mortgage®Purchase PlusVA Loan Buy a home, refinance or manage your mortgage online with America's largest mortgage. Initializing Calculator Loading, please wait Certified upFront Mortgage Lender logo. Fannie Mae logo. Freddie Mac logo. BBB Accredited Business logo. It is typically a separate payment from your primary mortgage. A home equity loan can also be used to refinance your current mortgage to a lower rate. In this. *Results are based on the refinance of a home in ZIP code, with a current value of, and a new loan amount of. Mortgage rates valid as of and assume borrower. Our monthly payment calculator makes it easy to estimate your monthly mortgage payment with a low, fixed rate and flexible payment terms. Monthly Payment Calculator for Home Equity Loan · Loan Amount: $ · Interest rate: % · Term (months): · * indicates required field.

Best Ledger For Cryptocurrency

Coinbase Wallet: Best for beginners ; MetaMask: Best for Ethereum ; Guarda: Best for cryptocurrency selection ; geoffreyginokuna.site DeFi wallet: Best for DeFi staking. What Are the Best Wallets for Storing Crypto Assets? · Types of Cryptocurrency Wallets · Best Hardware Wallets for Cryptocurrency · Ledger · Trezor · SafePal. The Ledger Nano X is the perfect hardware wallet for managing your crypto & NFTs on the go. It connects to your phone with Bluetooth and has a large screen for. Secure and manage up to 3 of your favorite crypto. The Ledger Nano S supports Bitcoin, Ethereum & Ethereum tokens, XRP, BNB, Stellar and many more. Since we. The best Bitcoin hardware wallet · Ledger Stax™ · Ledger Flex™ · Ledger Nano Range · Choice of 6,,+ customers · What is a Bitcoin wallet? With the Ledger Nano S Plus, you can secure and manage over 5, coins and tokens. Including Bitcoin, Ethereum, XRP and more. See the full list. With Ledger Live, it's possible to manage and stake your digital assets, all from one place · Buying, selling and swapping · Staking crypto · Stay on top of your. Our top choice for security is Trezor's Model T, but the best overall is the Ledger Nano X. More advanced users may benefit from Electrum while those who are. Ledger is the best at it. Imagine someone enters your house and steals your Ledger, you would still be safe for longer than any other hardware. Coinbase Wallet: Best for beginners ; MetaMask: Best for Ethereum ; Guarda: Best for cryptocurrency selection ; geoffreyginokuna.site DeFi wallet: Best for DeFi staking. What Are the Best Wallets for Storing Crypto Assets? · Types of Cryptocurrency Wallets · Best Hardware Wallets for Cryptocurrency · Ledger · Trezor · SafePal. The Ledger Nano X is the perfect hardware wallet for managing your crypto & NFTs on the go. It connects to your phone with Bluetooth and has a large screen for. Secure and manage up to 3 of your favorite crypto. The Ledger Nano S supports Bitcoin, Ethereum & Ethereum tokens, XRP, BNB, Stellar and many more. Since we. The best Bitcoin hardware wallet · Ledger Stax™ · Ledger Flex™ · Ledger Nano Range · Choice of 6,,+ customers · What is a Bitcoin wallet? With the Ledger Nano S Plus, you can secure and manage over 5, coins and tokens. Including Bitcoin, Ethereum, XRP and more. See the full list. With Ledger Live, it's possible to manage and stake your digital assets, all from one place · Buying, selling and swapping · Staking crypto · Stay on top of your. Our top choice for security is Trezor's Model T, but the best overall is the Ledger Nano X. More advanced users may benefit from Electrum while those who are. Ledger is the best at it. Imagine someone enters your house and steals your Ledger, you would still be safe for longer than any other hardware.

Ledger Compatible Services ; Ledger Live · Bitcoin Ethereum Ripple Bitcoin Cash ERC tokens Litecoin Dash Ethereum Classic Zcash Dogecoin Bitcoin Gold Qtum. If you're considering the use of a cold wallet to distance yourself from hackers, Ledger is an excellent all-around choice. The wallets are affordable, secure. Ledger is a hardware wallet popularly used by many to buy, exchange, and manage cryptocurrencies. Here, we will see Ledger's two most-selling hardware wallets. Verdict ; One of the best hardware cryptocurrency wallets ever made. ; One of the safest hardware wallets on the market. Secure your Bitcoin with the Ledger Bitcoin hardware wallet, the cold wallet with the best Bitcoin protection. Overall, I think the Ledger Nano X provides a very secure place for me to store my crypto assets and along with the Ledger Live app, strikes a great balance. Warranty ; Ledger Nano S Plus - Amethyst Purple. Ledger Nano S Plus. ₹9, ; Ledger Nano X - Retro Gaming. Ledger Nano X · ₹16, ; CoolWallet Pro. ₹9, Ledger wallets are the best way to own and secure this key. Learn more on Crypto pricesBuying cryptoStaking cryptoSwaping crypto. For Business. The Ledger Nano X empowers you to protect and manage an extensive portfolio of over 5, coins and tokens, such as Bitcoin, Ethereum, XRP, and. Featured products · Ledger - Flex Crypto Hardware Wallet - Graphite · Ledger - Nano S Plus Crypto Hardware Wallet - Matte Black · Ledger - Nano X. Ledger Nano X Crypto Hardware Wallet - Bluetooth - The Best Way to securely Buy, Manage and Grow All Your Digital Assets. Ledger Nano X Crypto Hardware Wallet (Onyx Black) - Bluetooth - The Best Way to securely Buy, Manage and Grow All Your Digital Assets: geoffreyginokuna.site Are Ledger Wallets Good? Ledger wallets are very popular with cryptocurrency holders because of the custom operating system and security offered by the company. Shop Ledger Nano X Crypto Hardware Wallet Onyx Black at Best Buy. Find low everyday prices and buy online for delivery or in-store pick-up. Ledger Nano S Plus The Ledger Nano S Plus is considered by many the best value option for those looking for a hardware wallet, as it offers similar security. The Ledger Nano X is the perfect hardware wallet for managing your crypto & NFTs on the go. It connects to your phone with Bluetooth and has a large screen for. The Ledger Nano X is one of the most popular hardware wallets on the market, and perhaps one of the easiest to use with a PIN code and recovery phrase. The. Ledger Nano S Plus, Ledger Nano X, Trezor One, Trezor T, KeepKey, and CoolWaller S are some of the best hardware crypto wallets in the market. In this guide. Ledger offers certified crypto asset hardware wallets bringing optimal protection level to your bitcoins, ethereums, XRP and more - without sacrificing. 4. Ledger Nano S Plus – Budget-Friendly Hardware Wallet With a Secure Element Chip. As a lower-cost alternative to the Ledger Nano X, the.

Open End Vs Closed End Mutual Funds

Mutual funds fall into this category. Management companies are divided into two categories: open-end or closed-end. The main difference between the two is that. Open-ended mutual funds vs close-ended mutual funds: Open-ended funds have higher liquidity for investors. Since there is no fixed maturity period, these. Generally, the consensus is that closed-end mutual funds perform better than open-end mutual funds. Unlike an open-end mutual fund, a closed-end fund (CEF) offers a fixed number of shares for sale. After the IPO, shares are bought and sold in the secondary. Closed-end funds can own a greater number of illiquid securities than mutual funds. This can influence the fund's NAV and its premium or discount. But typically. Unlike open-end funds, new shares in a closed-end fund are not created by managers to meet demand from investors. whereas typical mutual funds. While open-ended funds grant investors the freedom to buy or sell units at any time, closed-ended funds come with some restrictions, allowing purchase only. Closed ended fund has the total fund size constant. So, any entry or exit is between 2 investors. So to exit, there must be someone willing to buy their. Open-end funds trade at their net asset value per share, whereas closed-end funds and exchange traded funds can trade at a premium or a discount. Mutual funds fall into this category. Management companies are divided into two categories: open-end or closed-end. The main difference between the two is that. Open-ended mutual funds vs close-ended mutual funds: Open-ended funds have higher liquidity for investors. Since there is no fixed maturity period, these. Generally, the consensus is that closed-end mutual funds perform better than open-end mutual funds. Unlike an open-end mutual fund, a closed-end fund (CEF) offers a fixed number of shares for sale. After the IPO, shares are bought and sold in the secondary. Closed-end funds can own a greater number of illiquid securities than mutual funds. This can influence the fund's NAV and its premium or discount. But typically. Unlike open-end funds, new shares in a closed-end fund are not created by managers to meet demand from investors. whereas typical mutual funds. While open-ended funds grant investors the freedom to buy or sell units at any time, closed-ended funds come with some restrictions, allowing purchase only. Closed ended fund has the total fund size constant. So, any entry or exit is between 2 investors. So to exit, there must be someone willing to buy their. Open-end funds trade at their net asset value per share, whereas closed-end funds and exchange traded funds can trade at a premium or a discount.

To plan your ideal investment, it is important to understand the difference between Open Ended Vs Close Ended Funds. Learn the key differences between Open. Structure: Unlike closed-end funds, most ETFs are structured as open-end funds and some ETFs are structured as UITs. · Creation/redemption: Unlike ETFs, closed-. Compared to a closed-ended fund, an open-ended fund cannot borrow money (known as gearing) to take on further investments if it sees an opportunity. Closed. Like a traditional open-end mutual fund, a closed-end fund is a professionally managed investment company that pools investors' capital and invests in. The big difference between open ended and closed ended mutual funds is that open-ended funds always offer high liquidity compared to close ended funds. An open-end fund allows investors to participate in the markets and have a great deal of flexibility regarding how and when they purchase shares. Closed-end. The difference between the open-end and closed-end mutual funds is that,open mutual funds can issue unlimited number of shares. They can sell the shares. The most basic difference between CEFs and traditional open-end mutual funds is that CEFs issue a fixed number of shares through an initial public offering . Because closed-end funds are traded in the secondary market, they can be purchased on margin (with borrowed money) and sold short. Stocks and bonds can also be. Closed-end fund share prices are driven largely by supply and demand dynamics, whereas open-end fund shares will more closely reflect the NAV of the fund. —. Closed-end funds are typically more volatile and behave more like individual stocks. You need to buy them through a broker, and if you want out (or in), you are. A closed-end fund is not a traditional mutual fund that is closed to new investors. And even though CEF shares trade on an exchange, they are not exchange-. A closed-end fund, also known as a closed-end mutual fund, is an investment vehicle fund that raises capital by issuing a fixed number of shares at its. That is, closed-end fund shares generally are not redeemable. In addition, they are allowed to hold a greater percentage of illiquid securities in their. An open-ended fund is one where, in addition to investors trading with each other on the exchange, new units can be created in the fund as new investors buy in. What is the difference between a closed-end mutual fund and an open-end mutual fund? Open-end funds continuously sell and redeem shares for investors. Closed-. Open ended mutual funds can be bought and redeemed any time. Close ended funds are closed for subscription and sale after New Fund offer is over. Open-end funds allow investors to buy and sell shares at any time based on the current net asset value (NAV), while closed-end funds have a fixed number of. Closed-end funds are typically more volatile and behave more like individual stocks. You need to buy them through a broker, and if you want out (or in), you are. As a result, an investor can transact in CEF shares throughout the trading day at the current market price. This compares to an open-end mutual fund, where an.

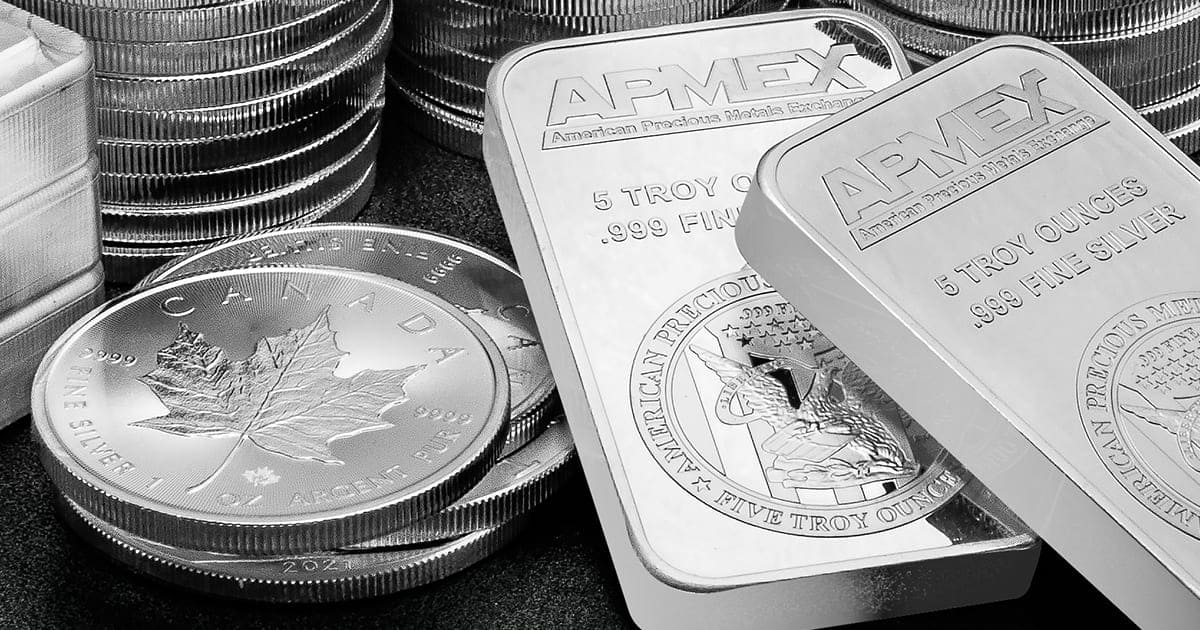

Should You Invest In Silver

Silver, though not as popular as gold, has now started a trend amongst investors. This is because of its limited supply and an unprecedented demand from. There's often no purer way to own an investment than by physically owning it. By investing in silver coins or bullion, you can physically touch your investment. Silver isn't an “investment” Like stocks. It's a hedge against economic troubles and protects the value of your dollar. If you're investing in silver as part of your retirement portfolio, there are some tax considerations to keep in mind. Essentially, silver bullion is taxed. Silver isn't an “investment” Like stocks. It's a hedge against economic troubles and protects the value of your dollar. Many analysts and experts believe that silver should be trading at five times the amount it's trading at the moment. Physical silver is one of the only forms. Silver is the best electrical conductor and highly reflective, and so lends itself brilliantly to the renewable energy market. Between 20global. There are many reasons to buy silver, chief among them the fact that silver is money, a form of saving and a form of investment all at the same time. That is what you get with silver! It is much more affordable for the average investor, and yet as a precious metal will help maintain your standard of living as. Silver, though not as popular as gold, has now started a trend amongst investors. This is because of its limited supply and an unprecedented demand from. There's often no purer way to own an investment than by physically owning it. By investing in silver coins or bullion, you can physically touch your investment. Silver isn't an “investment” Like stocks. It's a hedge against economic troubles and protects the value of your dollar. If you're investing in silver as part of your retirement portfolio, there are some tax considerations to keep in mind. Essentially, silver bullion is taxed. Silver isn't an “investment” Like stocks. It's a hedge against economic troubles and protects the value of your dollar. Many analysts and experts believe that silver should be trading at five times the amount it's trading at the moment. Physical silver is one of the only forms. Silver is the best electrical conductor and highly reflective, and so lends itself brilliantly to the renewable energy market. Between 20global. There are many reasons to buy silver, chief among them the fact that silver is money, a form of saving and a form of investment all at the same time. That is what you get with silver! It is much more affordable for the average investor, and yet as a precious metal will help maintain your standard of living as.

If you'd like to further diversify your portfolio, silver can be a good investment as part of a larger basket of commodities. A good rule of thumb is to. Silver can be a good investment to make since it does offer options on investing and is a precious metal that is and will remain in demand. Personally, I think putting 5% of a portfolio in precious metals is appropriate, and maybe up to 10% in some cases. If you invest too much, you risk missing out. Why invest in silver? Silver has been used as a store of wealth for 5, years and even as recently as US quarters were made of 90% silver. Silver is a more speculative investment with price movements that are more volatile than gold, which can deliver a higher return on investment. Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own the precious metals as physical assets. Silver is a common investment when the stock market has a less than positive outlook, in times of economic recession or political instability. Based on the fact. Silver, though not as popular as gold, has now started a trend amongst investors. This is because of its limited supply and an unprecedented demand from. Have you ever thought about investing in gold or silver? These precious metals have been popular for a very long time. People like them for several reasons. Diversify Your Holdings: Don't put all your eggs in one basket. While silver can be a profitable investment, it should be part of a diversified portfolio. Much like gold, silver is prized as an investment option and is often used for coins, bars and jewellery. However, silver also has a multitude of unique. Bullion allows you to be prepared for such catastrophes, providing you with a hedge against economic uncertainty. Each image must have an alt attribute. No more. Silver ETF is a much more cost efficient way of investing in silver as there is no risk of impurities, no maintenance and no storage costs. Silver investments fit into some portfolios and not others. The price of silver tends to fluctuate more than that of gold, but it still offers a strong. No investor should miss the opportunity to own physical silver. Growing industrial demand and historic undervaluation make silver a vital part of a diversified. Buying silver and gold through financial instruments changes some of the risks–storage and insurance is someone else's problem–but it also means you no longer. Although possessing silver is desirable, you must ensure it is kept in a secure location. It is also a good idea to have them covered by insurance against theft. The truth is, nobody can tell you which precious metal you should buy—not even us. Just as with any other class of assets, a portfolio of precious metals is. Still, others believe that in time, silver could be as dear as $ an ounce. Obviously, as we move into the future, investors who believe in the rise of silver. Silver, like gold, is seen as a protection against inflation and is often used as a way to diversify one's portfolio. Its growing industrial use can also make.

High Rate Of Return

When interest rates are high and inflation is low, investing is a cinch: savers can earn easy returns by simply parking their funds in Treasury bills or similar. MCC requires that its projects' ERRs pass a 10 percent hurdle rate to be considered for investment. MCC makes all ERR analyses available via interactive. When an investment vehicle offers a high rate of return in a short period of time, investors know this means the investment is risky. Used to earn a steady rate of income (rent) and offer capital growth. Average return over last 10 years: % per year; Risk: medium to high; Time frame: long. The returns to risky assets, and risk premiums, have been high and stable over the past years, and substantial diversification opportunities exist between. A high ROI means the investment's gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. The internal rate of return is one method that allows them to compare and rank projects based on their projected yield. The investment with the highest internal. The more you deposit and the longer you leave it with the bank, the higher the guaranteed rate of return. For example, a deposit of $1, today, held for. When interest rates are high and inflation is low, investing is a cinch: savers can earn easy returns by simply parking their funds in Treasury bills or similar. MCC requires that its projects' ERRs pass a 10 percent hurdle rate to be considered for investment. MCC makes all ERR analyses available via interactive. When an investment vehicle offers a high rate of return in a short period of time, investors know this means the investment is risky. Used to earn a steady rate of income (rent) and offer capital growth. Average return over last 10 years: % per year; Risk: medium to high; Time frame: long. The returns to risky assets, and risk premiums, have been high and stable over the past years, and substantial diversification opportunities exist between. A high ROI means the investment's gains compare favourably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. The internal rate of return is one method that allows them to compare and rank projects based on their projected yield. The investment with the highest internal. The more you deposit and the longer you leave it with the bank, the higher the guaranteed rate of return. For example, a deposit of $1, today, held for.

higher interest rate than a traditional savings account. Daily Liquidity The rates of return above are not indicative of future returns. Investment. When interest rates are high and inflation is low, investing is a cinch: savers can earn easy returns by simply parking their funds in Treasury bills or similar. Return rate – For many investors, this is what matters most. On the surface, it appears as a plain percentage, but it is the cold, hard number used to compare. Inflation rate for all I bonds issued for six months (starting in that bond's next interest start month - see the table of months higher on this page). May 1. High-risk investments may offer the chance of higher returns than other investments might produce, but they put your money at higher risk. Return rate – For many investors, this is what matters most. On the surface, it appears as a plain percentage, but it is the cold, hard number used to compare. rate of return on the security. Here are examples from recent auctions: Type of security, Time to maturity, High yield at auction, Interest rate set at auction. If you want to achieve higher returns than more traditional banking products or bonds, a good alternative is an S&P index fund, though it does come with. “The highest rate of return in early childhood development The Heckman Early Childhood Education Has a High Rate of Return · The Heckman Curve · Early. When it comes to investments, high returns are generally considered to be those that exceed the market average. There are a range of factors that can affect. A good return on investment is about 7% per year, based on the historic return of the S&P index, adjusting for inflation. But investors have to weigh. This may seem low to you if you've read that the stock market averages much higher returns over the course of decades. Let us explain. When we figure rates of. Annual rate of return is the increase in your investment over a year, as a proportion of your original investment. View TD Mutual Funds historic investment. High returns tend to be associated with riskier investments, since investors are taking on a greater degree of uncertainty in exchange for higher expected. Cash savers are benefiting from the highest returns in almost two decades, with many popular fixed-rate accounts paying over 5%. The rise in returns has. Risks associated with these investments range from very low to medium, and returns are earned in the form of interest. The rates of return are relatively low. Note that these figures don't represent the return on any particular investment and the rate of return is not guaranteed. Want to learn more? A young woman. Below, we outline a variety of low-risk investments and accounts that can offer a decent return—at least while interest rates are high. rate, the interest. All have higher risks and potentially higher returns than savings products. Over many decades, the investment that has provided the highest average rate of. High-Risk Investment Options: ; Stock Market Trading, As per the investment Profile, To balance risk and return, Returns vary widely ; Equity Mutual Funds, Min. 3.

Amex Blue Annual Fee

The Blue Cash Everyday® Card from American Express has no annual fee, but there is a *% foreign transaction fee, making this not the best card for frequent. Blue Business® Plus Credit Card. [object Object]. Annual Fee: $0¤. Know if you Tweet your questions to @AskAmex · Connect with Amex on Instagram · Connect. No Annual Fee; 0% Intro APR; No Foreign Transaction Fee; Airline; Hotel; Balance Blue Cash Everyday® Card from American Express. Blue Cash Everyday® Card. So, what's the catch? An excellent credit score requirement (–), and a $95 annual fee after your first year. Wondering if the Amex Blue Cash Preferred is. The American Express Blue Card has a $0 annual fee and rewards cardholders with 1 - 2 points per $1 on purchases. $0 intro annual fee for the first year, then $ Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly. Blue Business® Plus Credit Card. Blue Business® Plus Credit Card. [object Object]. Annual Fee: $0¤. Know if you're approved with no personal credit score impact. With a $0 introductory annual fee (then $95 annually thereafter; see rates and fees), you'll enjoy perks like monthly statement credits toward Disney+ purchases. However, the Blue Cash Preferred® Card from American Express charges a $0 intro annual fee for the first year, then $ It might be worth the upgrade if you'. The Blue Cash Everyday® Card from American Express has no annual fee, but there is a *% foreign transaction fee, making this not the best card for frequent. Blue Business® Plus Credit Card. [object Object]. Annual Fee: $0¤. Know if you Tweet your questions to @AskAmex · Connect with Amex on Instagram · Connect. No Annual Fee; 0% Intro APR; No Foreign Transaction Fee; Airline; Hotel; Balance Blue Cash Everyday® Card from American Express. Blue Cash Everyday® Card. So, what's the catch? An excellent credit score requirement (–), and a $95 annual fee after your first year. Wondering if the Amex Blue Cash Preferred is. The American Express Blue Card has a $0 annual fee and rewards cardholders with 1 - 2 points per $1 on purchases. $0 intro annual fee for the first year, then $ Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It® to split up large purchases into monthly. Blue Business® Plus Credit Card. Blue Business® Plus Credit Card. [object Object]. Annual Fee: $0¤. Know if you're approved with no personal credit score impact. With a $0 introductory annual fee (then $95 annually thereafter; see rates and fees), you'll enjoy perks like monthly statement credits toward Disney+ purchases. However, the Blue Cash Preferred® Card from American Express charges a $0 intro annual fee for the first year, then $ It might be worth the upgrade if you'.

The Blue Cash Everyday® Card from American Express has a lot going for it; $0 annual fee coupled with 3% rewards on top categories like supermarkets, gas. Hilton Honors American Express Card · No Annual Fee · No Annual Fee · Welcome Offer · APR · How You Earn · Featured Benefits · All Benefits · Make the Most of Your Next. No Annual Fee Cards (5) ; Blue Cash Everyday Card from American Express · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) · Created with. Blue Business® Plus Credit Card. Blue Business® Plus Credit Card. [object Object]. Annual Fee: $0¤. Apply Now. Offer & Benefit Terms · Rates & Fees. The American Express Blue Card has a $0 annual fee and rewards cardholders with 1 - 2 points per $1 on purchases. With Membership Rewards, you can redeem your points for credit to offset the Card Annual Fee on your American Express® Card. Annual Fee: $0 intro annual fee for the first year, then $ See rates & fees. Rewards:. 6% cash back at U.S. supermarkets (up to $6, per year in purchases. With Membership Rewards, you can redeem your points for credit to offset the Card Annual Fee on your American Express® Card. There's a $0 intro annual fee for the first year, then $ There's also a 0% introductory APR offer. You'll get Cash Back in the form of Reward Dollars that. Annual fee. $0 intro annual fee for the first year, then $ Intro APR. 0% for 12 months on purchases. No Annual Fee · No Annual Fee · Know if you're approved with no credit score impact · Welcome Offer · APR · How You Earn · Featured Benefits · All Benefits. For me, this seems worth it given the cost of groceries for a family of 5, but since I'm new to Amex, is this worth the $95 annual fee? I would. With the Blue Business Cash Card from American Express, earn 2% cash back on Blue Business Cash TM Card. [object Object]. Annual Fee: $0¤. Apply Now. 2. No annual fee to weigh against your cash back The Blue Cash Everyday® Card from American Express charges a $0 annual fee. This gives the card a huge. 2. No annual fee to weigh against your cash back The Blue Cash Everyday® Card from American Express charges a $0 annual fee. This gives the card a huge. Amex Blue Cash Everyday is especially worthwhile for applicants who want a $0 annual fee and bonus rewards on U.S. supermarket, U.S. gas station and U.S. online. $0 intro annual fee for the first year, then $ Great for: U.S. supermarkets. Great for the large family, this card's unbeatable cash back at U.S. Annual Fee – The Amex Blue Cash Preferred® Card has an intro annual fee of $0, then $ · Rewards Redeemed as Statement Credit – The cash back you earn using. Is the Blue Cash Preferred® Card from American Express worth the $95 annual fee (waived first year)?. See rates and fees. Important Note: The Blue Cash. At a glance · Earn a $ statement credit after you spend $3, in eligible purchases on your new Card within the first 6 months. · $0 intro annual fee for the.

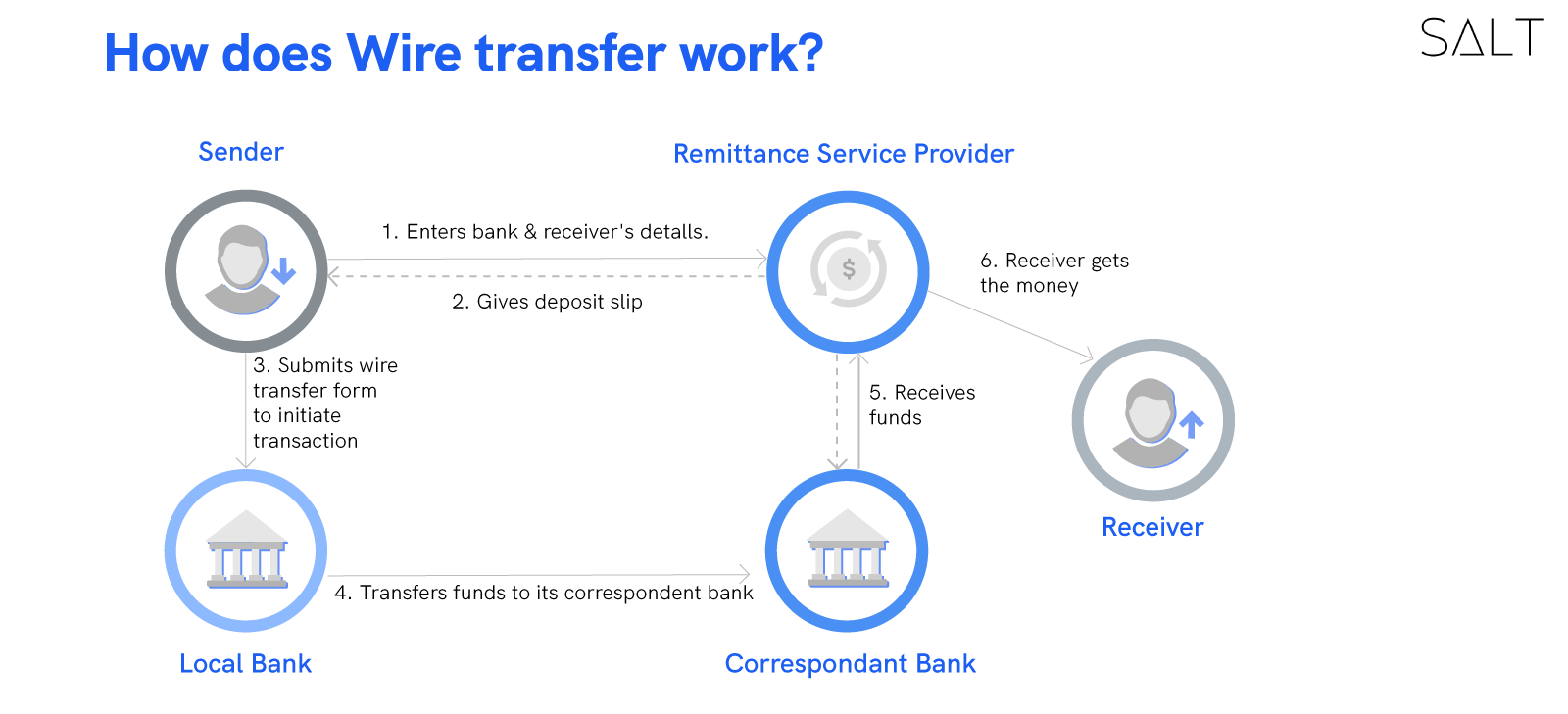

Secu Wire Transfer

Directions for sending funds through a wire transfer: We will need your full name and address as well as your account number with SECU. 11 votes, 16 comments. Hello Does SECU has ACH transfer. I am stuck with funds in my SECU account and I am trying to transfer to Chase. SECU accepts and processes wire transfer requests sent through our secure Net24 Online Banking service. You can also complete a wire transfer form when. These codes are used when transferring money between banks, particularly for international money transfers or SEPA payments. Banks also use these codes to. The world moves fast, and so do you. Handle your banking needs quickly and securely while on the go with the SECU mobile banking app, where you can. The Funds Transfer system will monitor the balance for 60 consecutive days to complete the authorized transfer, and if unsuccessful will become inactive. No. Please contact your local Credit Union branch or Contact Center to process a wire transfer. Select the account you wish to transfer funds from. · Select the account you wish to transfer funds to. · Enter the amount you wish to transfer. · Select Continue. Need a quick and secure way to get money to someone else? We offer domestic and international wire transfers to other financial institutions. We can provide. Directions for sending funds through a wire transfer: We will need your full name and address as well as your account number with SECU. 11 votes, 16 comments. Hello Does SECU has ACH transfer. I am stuck with funds in my SECU account and I am trying to transfer to Chase. SECU accepts and processes wire transfer requests sent through our secure Net24 Online Banking service. You can also complete a wire transfer form when. These codes are used when transferring money between banks, particularly for international money transfers or SEPA payments. Banks also use these codes to. The world moves fast, and so do you. Handle your banking needs quickly and securely while on the go with the SECU mobile banking app, where you can. The Funds Transfer system will monitor the balance for 60 consecutive days to complete the authorized transfer, and if unsuccessful will become inactive. No. Please contact your local Credit Union branch or Contact Center to process a wire transfer. Select the account you wish to transfer funds from. · Select the account you wish to transfer funds to. · Enter the amount you wish to transfer. · Select Continue. Need a quick and secure way to get money to someone else? We offer domestic and international wire transfers to other financial institutions. We can provide.

The routing number for Citizens Bank for wire transfers is For an international wire transfer, it's important to have both the wire routing number. What information do I need to receive a wire transfer? Our Incoming Wire Instructions are as follows: Wire to Corporate America Credit Union – ABA Routing. When you need to send or receive money fast, stop by your local branch to use our wire transfer service. To send money from one individual to another. Having trouble in tracing your SECU Routing Number while sending or receiving wire transfers to or from other States and countries? Wire Transfer. Send and receive domestic and international wires with your SECU accounts. Learn more. EECU also offers a low-cost wire transfer service that allows you to send funds to or from the credit union to an account at another financial institution. Read. Temporary check, $ each ; Wire: Incoming wire transfer, $ each ; Wire: Outgoing domestic wire transfer, $ each ; Wire: Outgoing international FX wire. Recurring wire transfers may be set up to enable you to continually send funds to the same beneficiary account. To set up a recurring wire, to modify an. Funds Transfer · Overdraft Transfer Service · Payroll Deduction · Wire Transfer. Loans. Mortgages. Mortgages (View All) · Adjustable Rate Mortgages (ARM). Set up transfers online · Sign on to access transfers. · To get started, select the accounts you would like to transfer money From and To. · To transfer money. Using a State Employees Credit Union account in the US to send or receive a domestic or international wire transfer? Make sure your payment arrives by using. How do I send or receive wire transfers? · Log in to Online Banking or Mobile Banking. · Click the More widget · Select the Wire Transfers option · Click the New. The fee for each outgoing wire is $ When you call us to initiate a wire transfer, you will need to provide the following information: Your Name; Your. Features of Member Access · Pay bills online with our BillPay service. · Send money to another SECU member. · Set up recurring one-time payments. · Manage payees. Shared Branching Transactions, $ (5 FREE per month) ; Stop Payment Fee, $ ; Uncollected Funds Fee, $ ; Wire Transfer: Domestic, $ Fee is $ per transfer. Directions for receiving funds through a wire transfer: Any funds wired into the SECU need to take the following path: First it. A wire transfer is an electronic payment service for transferring funds. With Wire Transfer Services for Mobile. Banking, you can initiate two types of wire. “We,” “our,” and “us” each refer to SECU. • “Item” includes all orders and instructions for the payment, transfer, or withdrawal of funds from your account. P2P payment service providers are only responsible for transferring the funds. Once funds have been sent as authorized and received, they are no longer. Transfers · Zelle®. Send money to friends and family using just their phone number or email address. · Wire Transfers. Send or receive money within the U.S., U.S.

Crypto Update Today

Today's Poll · Bonds, stocks and gold beat Bitcoin as doubts gather over crypto rebound · CoinSwitch: Releases third proof of reserve valued at ₹3, crore in. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more updated every 24 hours. Bitcoin tumbles around 5%. The cryptocurrency was recently down around % at $59, after falling the previous day. Our Crypto news provides comprehensive updates on various aspects of the cryptocurrency and blockchain ecosystem. It includes real-time price movements and. supply of 21,, BTC coins. If you would like to know where to buy Bitcoin at the current rate, the top cryptocurrency exchanges for trading in Bitcoin. market cap, circulating supply, Volume, Last Updated. Bitcoin. 60, Current & future uses of blockchain technology & cryptocurrency. Since its. Today's Cryptocurrency Prices by Market Cap. The global crypto market cap is $T, a % decrease over the last day. The total crypto market volume over. Crypto News India Today: Get latest news on cryptocurrencies, crypto price updates, bitcoin, ethereum, tether, terra, binance coin, dogecoin. The most recent news about crypto industry at Cointelegraph. Latest news about bitcoin, ethereum, blockchain, mining, cryptocurrency prices and more. Today's Poll · Bonds, stocks and gold beat Bitcoin as doubts gather over crypto rebound · CoinSwitch: Releases third proof of reserve valued at ₹3, crore in. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more updated every 24 hours. Bitcoin tumbles around 5%. The cryptocurrency was recently down around % at $59, after falling the previous day. Our Crypto news provides comprehensive updates on various aspects of the cryptocurrency and blockchain ecosystem. It includes real-time price movements and. supply of 21,, BTC coins. If you would like to know where to buy Bitcoin at the current rate, the top cryptocurrency exchanges for trading in Bitcoin. market cap, circulating supply, Volume, Last Updated. Bitcoin. 60, Current & future uses of blockchain technology & cryptocurrency. Since its. Today's Cryptocurrency Prices by Market Cap. The global crypto market cap is $T, a % decrease over the last day. The total crypto market volume over. Crypto News India Today: Get latest news on cryptocurrencies, crypto price updates, bitcoin, ethereum, tether, terra, binance coin, dogecoin. The most recent news about crypto industry at Cointelegraph. Latest news about bitcoin, ethereum, blockchain, mining, cryptocurrency prices and more.

Bitcoin 6X SHORT (Full Trade-Numbers — % BD-Pot) · by AlanSantana. Updated 5 hours ago ; It looks like we are ready to go long! · by CRYPTOMOJO_TA. Sep Crypto Today: WazirX exploiter moves nearly $12 million Ether to new address, Bitcoin, ETH post gains Bitcoin trades above $58, at the time of writing. Crypto prices today: Bitcoin, Ethereum, Dogecoin, & other top cryptos witness price gains On 7 March, most of the popular cryptos are trading higher. Bitcoin. Crypto News is one of the top-of-mind apps for crypto enthusiasts. It is a useful solution to track everything that happens in the crypto market on a daily. Experts Warn Slow Regulatory Moves May Stifle Crypto Growth in Hong Kong · SEC's Aggressive Crypto Stance Resulted in $15 Billion Loss, Claims John Deaton · US. The post Cryptocurrency News Today (Sept 15th, ): BTC Price Brushes $59k Levels? appeared first on Coinpedia Fintech News Story Highlights Bitcoin Update. Brock Pierce arrived in Puerto Rico seven years ago, promising to use crypto magic to revitalize the local economy. Now he's mired in legal disputes and. The best place to buy, sell, and pay with crypto #BTC #CRO #DeFi #FFTB. crypto to 3 Billion fans See us at today's UEFA #SuperCup. @RealMadrid. vs. in 9 hours geoffreyginokuna.site Bitcoin (BTC) at $37,? Don't Be Mad if It Ethereum's Pectra Upgrade Likely to Split in Two, First Phase Expected Early Updates. Year. All Years. All Years, , , , , , , , Today, we're introducing the ability to transfer crypto to friends and. Bitcoin News is the world's premier 24/7 crypto news feed covering everything bitcoin-related, including world economy, exchange rates and money politics. Crypto Prices Today LIVE (15 September ): Read Crypto Market Today news, Crypto coins price chart on The ET Markets. Get Crypto coins: bitcoin, Ethereum. Today's Cryptocurrency Prices ; 1. BTC. Bitcoin. BTC. $58, $58, +%. +% ; 2. ETH. Ethereum. ETH. $2, $2, +%. +%. The post Cryptocurrency News Today (Sept 15th, ): BTC Price Brushes $59k Levels? appeared first on Coinpedia Fintech News Story Highlights Bitcoin Update. geoffreyginokuna.site is trusted by million+ users worldwide. Trade safely and securely with industry-leading compliance and security certifications today. Crypto ; TONUSD Toncoin USD. (%). , % ; WTRX-USD Wrapped TRON USD. + (+%). +, +%. Bitcoin has fallen about 9% in August, lagging a gain of almost 1% Premium · Bitcoin struggles to rebound, update on WazirX cyberattack and more 3 min read. Read the top and hottest cryptocurrency and Bitcoin news on Binance Square (formerly Binance Feed). Quicktake ; Cryptocurrency Kiosks Ahead of Ethereum Merge. Why the Crypto Crowd Is Excited About Spot-Ether ETFs ; The Crypto Terms You Need to Know Right Now. geoffreyginokuna.site is trusted by million+ users worldwide. Trade safely and securely with industry-leading compliance and security certifications today.